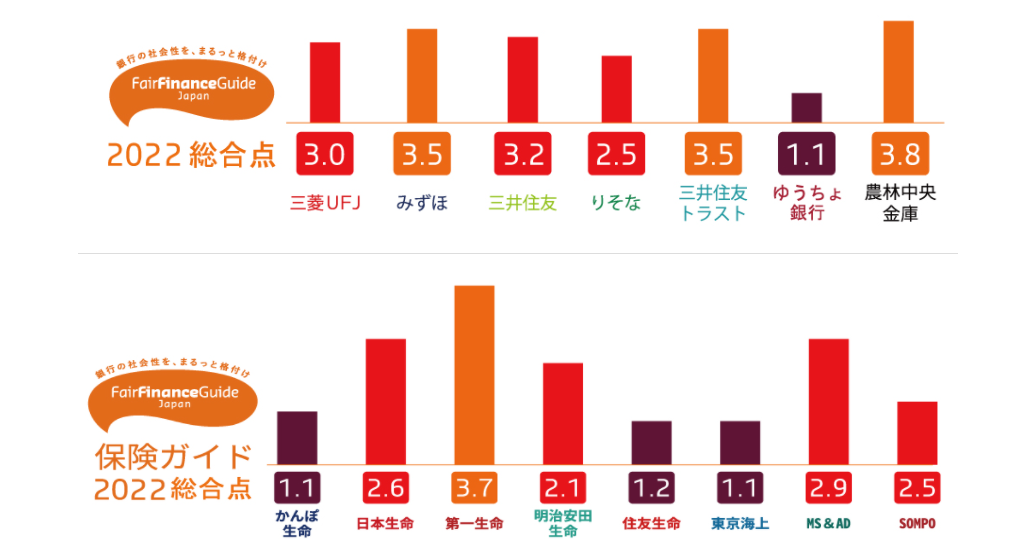

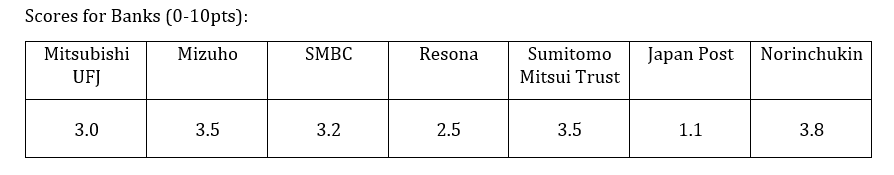

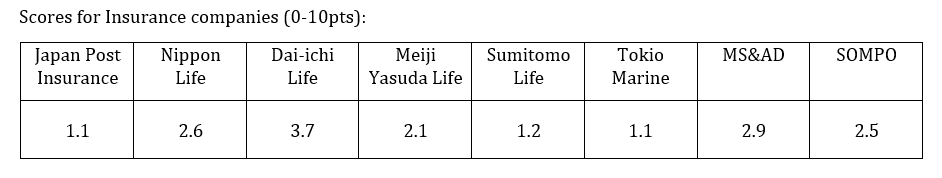

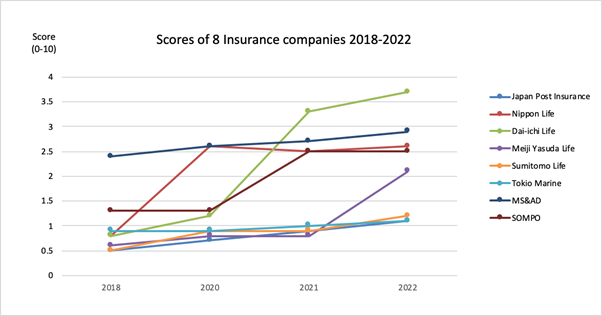

Japan – The latest set of scores was released by Fair Finance Guide Japan, a coalition of Japanese NGOs that shed light on the investment and lending policies of major financial institutions. Norinchukin Bank and Dai-ichi Life, which ranked top in the previous assessment last year, maintained the lead by further strengthening their policies.

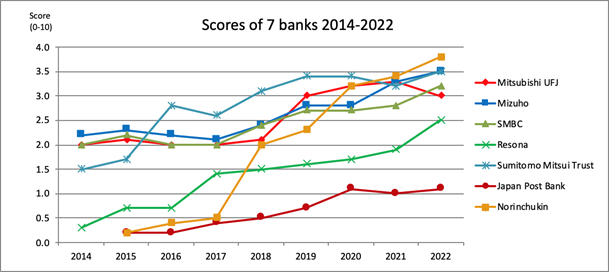

Most of the assessed financial institutions improved on their climate change policies, but still lag far behind their European counterparts, who score at an average of 6.4 points.

Norinchukin Bank improved their score by strengthening their policies, including a new policy for the arms industry, which states that the Bank will not provide direct financing or investment for the manufacturing of nuclear weapons, biological and chemical weapons, or anti-personnel mines. Dai-ichi Life has a lead over other insurance companies and banking groups, especially on the themes such as labor rights, human rights and diversity by setting these themes as agenda items for engagement with their investees.

In addition, Resona Bank notably improved their score by strengthening their lending policy, which states that the Bank will not finance projects that exert a negative impact on wetland sites designated by the Ramsar Convention or on the World Heritage Sites designated by UNESCO, or projects that violate the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). Meiji Yasuda Life, which ranked at the bottom in the previous year, increased their score by clarifying that they expect investees to comply with the UN Global Compact. On the other hand, Japan Post Bank, Japan Post Insurance and Tokio Marine ranked at the bottom this year.

The movement by financial institutions to shift financial flows towards the achievement of the goals of the Paris Agreement has been accelerating. Since the previous assessment, Mitsubishi UFJ, Mizuho, SMBC, Sumitomo Mitsui Trust, Dai-ichi Life, Nippon Life, Meiji Yasuda Life, Sumitomo Life, MS&AD and SOMPO made a commitment to aligning their lending and investment portfolios with net zero greenhouse gas (GHG) emissions by 2050. Also, all assessed financial institutions except for Norinchukin Bank, Japan Post Bank and Japan Post Insurance disclosed GHG emissions from their lending and investment portfolio – the efforts have been made to enhance climate-related financial disclosure.

The Fair Finance Guide International Methodology aims to promote a race-to-the-top between ESG efforts of financial institutions by scoring social and environmental dimensions of investment and lending policies of major financial institutions and providing the results to the public in an easy-to-understand manner. Dutch NGOs started this initiative in 2009, and Japan has participated since 2014. This is the 9th assessment for Japanese banking groups and the 4th assessment for insurance companies. Currently, the policy assessment is conducted more than in 11 countries.

Fair Finance Guide Japan is run by a network of non-profit organizations based in Japan: Alternative Peoples Linkage in Asia (APLA), Japan Center for a Sustainable Environment and Society (JACSES), Japan Tropical Forest Action Network (JATAN) and Pacific Asia Resource Center (PARC). This is a joint press release by these four organizations.

Contact:

Yuki Tanabe, Japan Center for a Sustainable Environment and Society (JACSES)

Email: tanabe@jacses.org